Homes in Detroit can run much cheaper than the national average. In January 2023, the median sale price nationally was $383,460, according to Redfin. In Detroit, it was just $77,500. The Detroit Land Bank Authority (DLBA), founded in 2008, sells run-down and vacant properties. Even without these programs, houses can still cost less than $2,000.

The only problem with low-priced homes: they need a lot of work. The DLBA has a compliance program that requires purchasers to either renovate and occupy or demolish the house. (H/T)

Deandra Averhart’s House Before Renovations.

Deandra Averhart

In June 2018, native Detroiter Deandra Averhart purchased a home through the DLBA’s Own It Now program for $2,690.50. She spent around $13,000 fixing it over 15 months. She kept her renovation costs relatively low by asking students for help clearing out debris and decorating with furniture she bought at thrift stores or on Craigslist, she told us.

Deandra explained how she transformed the property and her most significant takeaways from the project.

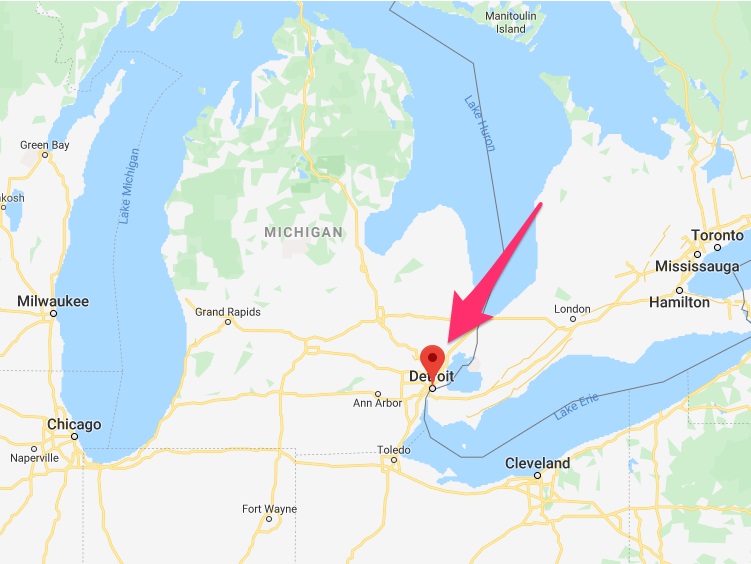

A brief history: Detroit, Michigan, was once home to a booming auto industry. However, in the 1950s, the city started declining, and companies began moving out. By the 1960s, people were leaving in droves.

In 2013, the city filed for Chapter 9 bankruptcy protection, the largest municipal bankruptcy in US history. Now more and more programs have explicit missions to improve the city.

The Detroit Land Bank Authority — the DLBA — is one of several organizations working to revitalize the city.

Michael S. Williamson/The Washington Post via Getty Images

A weaker housing market and lower-valued homes have made it difficult for Detroiters to obtain mortgages. The Detroit Home Mortgage program, which was in place in 2016, is working to increase homeownership in the city by lending qualified buyers the money needed to purchase and renovate homes in the town.

Through the program, Detroiters can receive two loans: The first mortgage is for the appraised value of the home, while the second mortgage, which has a limit of $75,000, closes the gap between the home’s sale price and its appraised value and covers the cost of renovations.

Deandra Averhart bought this abandoned three-bedroom, one-bathroom home in June 2018 through the DLBA.

Deandra Averhart

She told us that she wasn’t interested in buying a house. However, after talking to a friend, she decided that investing her money in homeownership was a better move than paying rent.

Averhart’s birth name is Tia DeShay, but it was legally changed to Deandra Averhart when she was adopted. She writes, has her podcast, and is a high school English teacher.

Deandra Averhart

Through the DLBA, she paid just $2,690.50 for the property.

Deandra Averhart

“Today, Thursday, June 21, 2018, at 10:00 am, I closed on this house—total Purchasing Price: $2690.50. I owe no mortgage, just property taxes,” she wrote on Instagram.

The house was in unlivable condition when she bought it, Averhart said.

Deandra Averhart

“It was completely trashed,” Averhart said. “It had a hole in the back underneath what I call the nook in the kitchen.”

Deandra Averhart

Trash was scattered throughout the house.

Deandra Averhart

There was also no running water or electricity.

Deandra Averhart

“There was nothing,” Averhart said. “There was no furnace, no hot water tank, nothing.”

Deandra Averhart

Averhart had her work cut out for her, but she wasn’t alone. With the help of her students, a coworker, and an independent contractor, she turned the abandoned house into a home.

Deandra Averhart

Her students helped with the cleaning and the landscaping. “They were going into their senior year, so I knew they needed money for senior activities,” Averhart said.

Deandra Averhart

Averhart hired an independent contractor to redo plumbing, fix electrical work, install new windows, and install new doors.

Deandra Averhart

Despite the home’s condition when she bought it, Averhart was able to move in just two months later.

Deandra Averhart

By that point, her bedroom, the bathroom, the living room, and the spiritual space were done.

Deandra Averhart

The kitchen, however, wasn’t yet ready.

Deandra Averhart

The kitchen wasn’t complete until a few months later.

Deandra Averhart

While Averhart worked on finishing the kitchen, her dining room was a makeshift kitchen.

Deandra Averhart

“I had a toaster oven, a microwave, and a refrigerator,” Averhart said. “That’s all I had.”

Deandra Averhart

Deandra sent the DLBA photos of the renovation progress every month. It took about a year and five months to fix up the house to her liking.

Deandra Averhart

Averhart found most of her decor second-hand or on Craigslist. “I am a thrift store queen,” she told us.

Deandra Averhart

Averhart said the most challenging part of the project was finding her patience. “Everything is not going to happen overnight,” she said. “I had to work around the contractor’s schedule, and I had to work around my schedule.”

Deandra Averhart

And, while buying a house wasn’t originally part of her plan, she said she doesn’t regret the purchase.

Deandra Averhart

“Every time I walk through my home, I am amazed that I did this,” Averhart said. “It brings tears to my eyes.”

Deandra Averhart

- The Detroit Land Bank Authority sells publicly owned properties in poor condition at low prices.

- That’s how high-school teacher Deandra Averhart purchased a three-bedroom home for just $2,690.50.

- Averhart broke down how she transformed the house while keeping renovation costs low.

Like what you are reading? Subscribe to our top stories.

Discussion about this post